INFUSE is a modern web-based lending management software solution designed for consumer and business lenders seeking a more efficient administration platform. The INFUSE loan management solution exhibits enhanced flexibility not normally associated with back-end financial systems. Organisations operating from multiple locations benefit from the system's centralised database which eliminates data duplication and redundancy while allowing end-users to directly access the system from wherever they are.

Coupled with our UNITISE Funds Administration Software, the two systems come together to provide a fully integrated solution to suit contributory and pooled mortgage fund managers. This way, you'll have both investors and borrowers well covered.

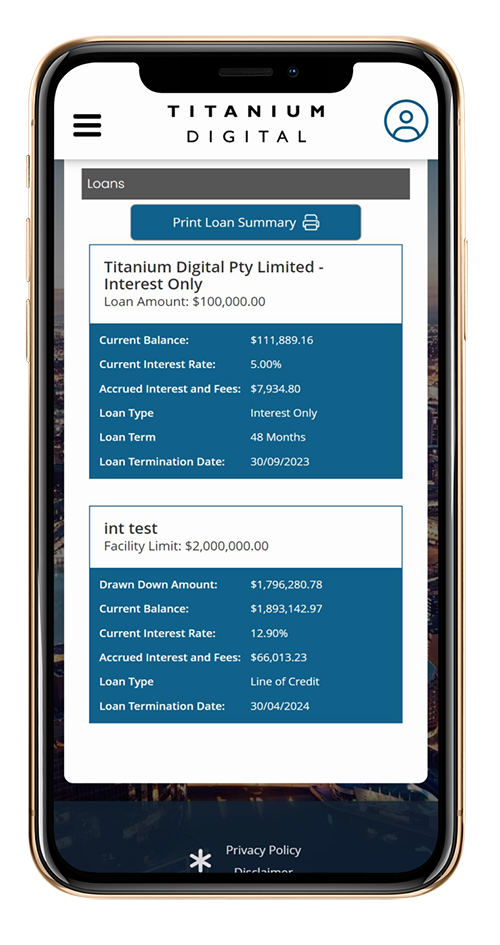

The package boasts clever features such as a built-in CRM, paperless document management, comprehensive user security rules and more. A concise, white-labelled online Borrower Portal can be made available to allow your borrowers to log in and view/manage their loans.

Flexible amortization calculations

Contract document preparation and printing

Security registers covering prior mortgage priorities

P&I, IO and lines of credit

Automatic line and loan management fee postings

Payments paid in arrears or advance

Direct debit repayment processing.

There's so much more to it. Speak to our solutions team today on how our lending management solution can best fit within your operation.

Our INFUSE Lending Management System is designed to improve the efficiency of your operation. Remove the guesswork and human error from your processes and ensure that your outputs are consistent with client expectations.

We are committed to offering compliant solutions to the market and providing regulatory updates to our clients as part of support and maintenance arrangements. You will also receive software enhancements and upgrades as part of our licencing model.

We understand how critically important it is for lenders to provide a consistently high-quality customer experience to borrowers. INFUSE is designed to ensure that outputs are clear, concise and on-time.

Scalability is at the heart of everything we do. We love to support clients throughout their growth trajectories and have seen many multiply their operations by many orders of magnitude.

As a "turn-key" solution, INFUSE provides a fast and effective pathway for start-ups to provide professional services to their borrowers from day one.

We recognise that the lending market can vary in its demands and that every lender tends to operate slightly differently. Titanium Digital is committed to providing flexible solutions that can be tailored to suit your unique business model.

Configure loan metrics for serviceability determination, loan categorisation, amortisation scheduling and interest/fee calculation.

Upload supporting docs and request approval from your credit team. Once approved, the application is handed back to lending officers.

Merge application data into your legal templates for a one-click loan documentation process.

Capitalise interest and line fees, manage repayments, email statements and more.

Take advantage of our off-the-shelf reports or allow us to tailor the solution to meet your unique requirements.

Feed data into our white-labelled online portal to provide borrowers with secure and convenient access to their data online.